Close More. Chase Less.

Close More. Chase Less.

Close More. Chase Less.

Close More. Chase Less.

System of Action for

Financial Services

All-in-one agentic platform driving conversion, retention, and cross-sell across mortgage and deposits.

All-in-one agentic platform driving conversion, retention, and cross-sell across mortgage and deposits.

Mortgage Growth

Deposit Expansion

Agentic AI

Unified System

Revenue Automation

Next Best Action

Omnichannel Engagement

Cross-Sell Intelligence

Revenue Automation

Next Best Action

The Problem and Solution

The Problem and Solution

The PROBLEM

The PROBLEM

Your Current CRM Responds. It Needs to Act.

Your Current CRM Responds. It Needs to Act.

Financial Services teams juggle disconnected systems. One for leads. One for calls.

Another for marketing. Another for pricing.

The result? Leads go cold. Follow-ups slip. Borrowers leave. Customers churn.

Your technology records activity. It doesn’t move deals forward.

You need a system that runs the pipeline for you.

The SOLUTION

The SOLUTION

One Platform. Every Channel. Mortgage and Deposit - Unified.

One Platform. Every Channel. Mortgage and Deposit - Unified.

Relcu unifies lead management, omnichannel engagement, AI automation, pricing, marketing, and analytics into a single System of Action built for financial services.

Built to support:

Consumer Direct

Retail

Wholesale

All-in-one platform dynamic enough for everything you do.

All-in-one platform dynamic enough for everything you do.

All-in-one platform dynamic enough for everything you do.

Convert: Capture, score, and distribute leads. Engage instantly with AI.

Retain: Identify at-risk borrowers. Automated retention campaigns.

Serve: Lifetime value through intelligent next-best-action.

Our Services

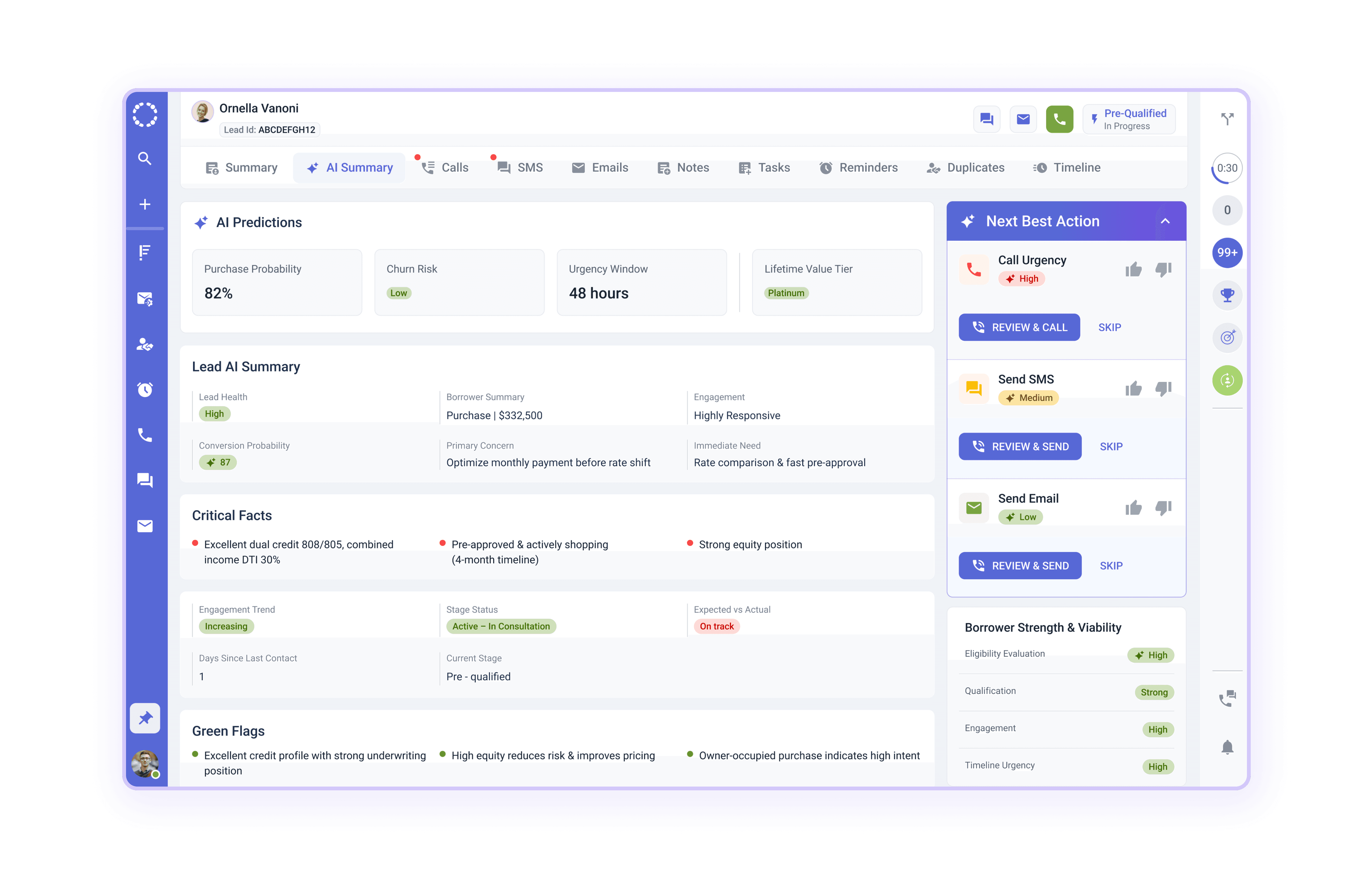

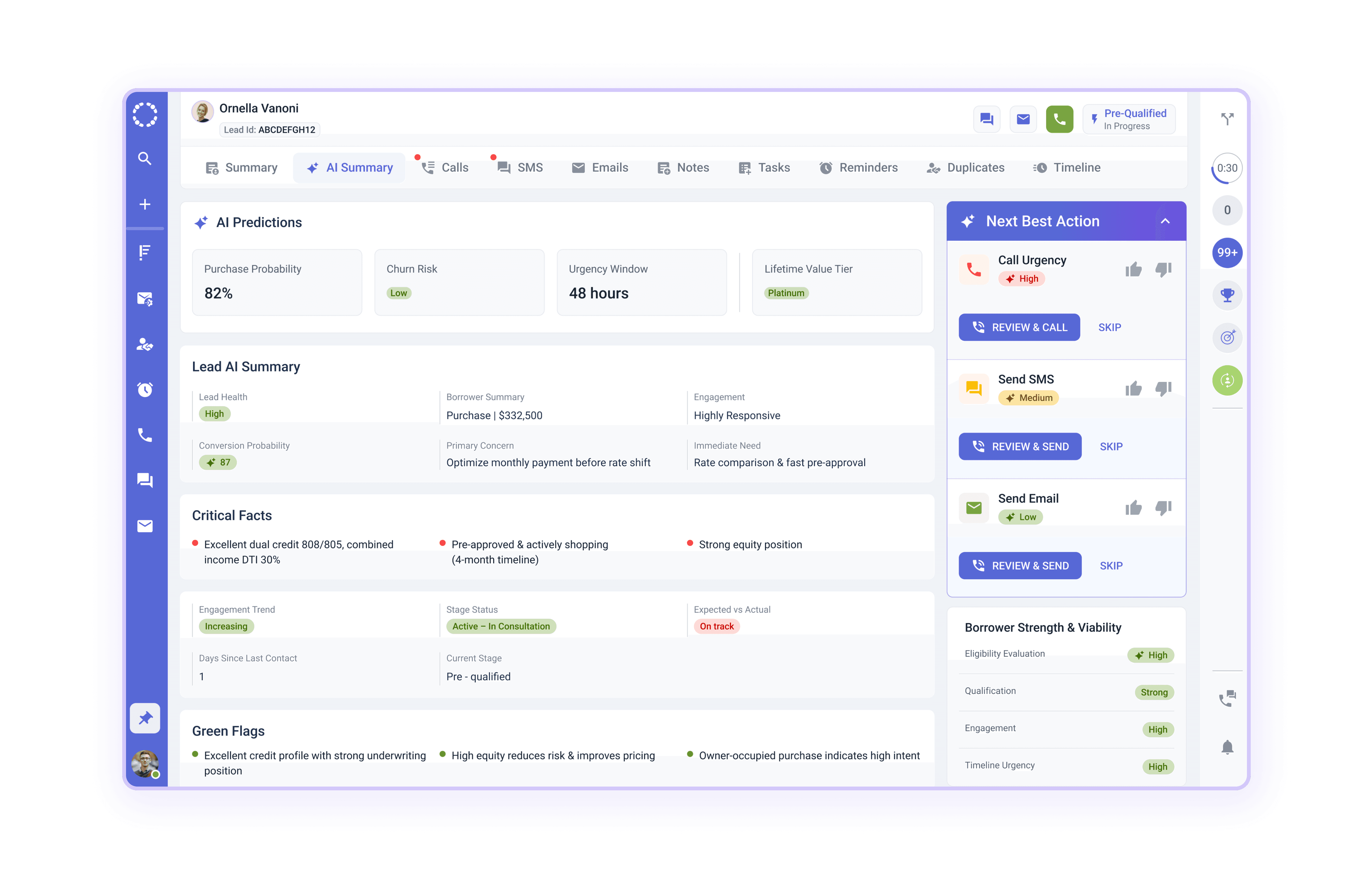

AI That Actually Works Your Leads

AI That Actually Works Your Leads

Not Just Insights. Actions.

Not Just Insights. Actions.

01

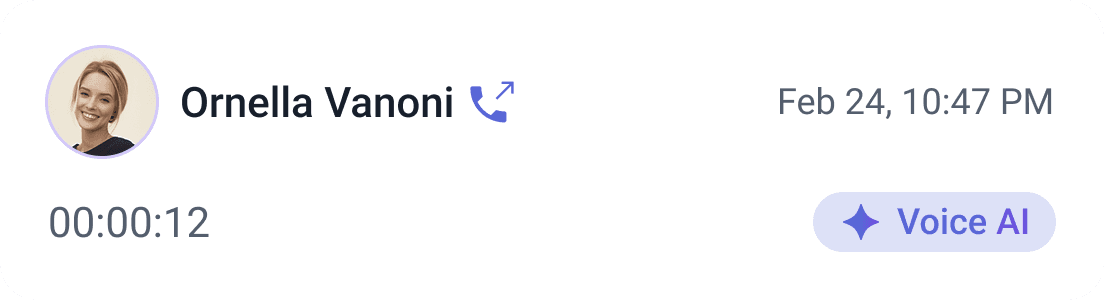

Voice AI

AI-powered calls that qualify, nurture, and book appointments

01

Voice AI

AI-powered calls that qualify, nurture, and book appointments

01

Voice AI

AI-powered calls that qualify, nurture, and book appointments

02

SMS AI

Intelligent text conversations that feel human

02

SMS AI

Intelligent text conversations that feel human

02

SMS AI

Intelligent text conversations that feel human

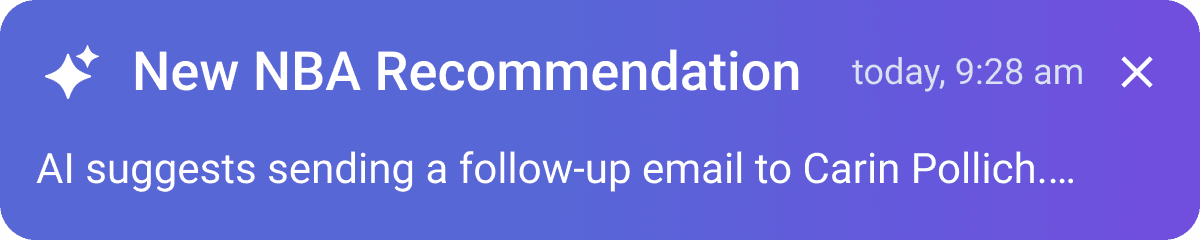

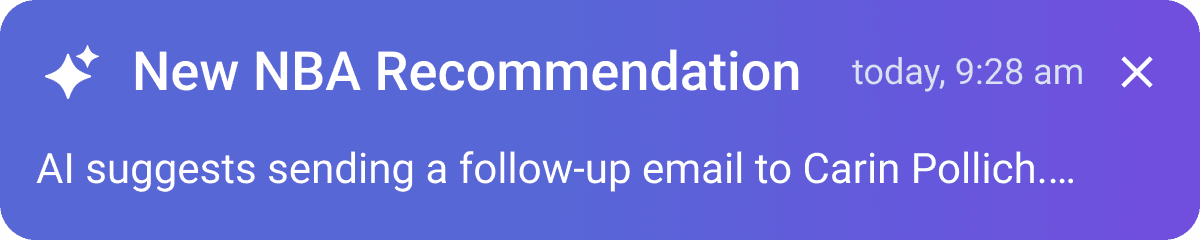

03

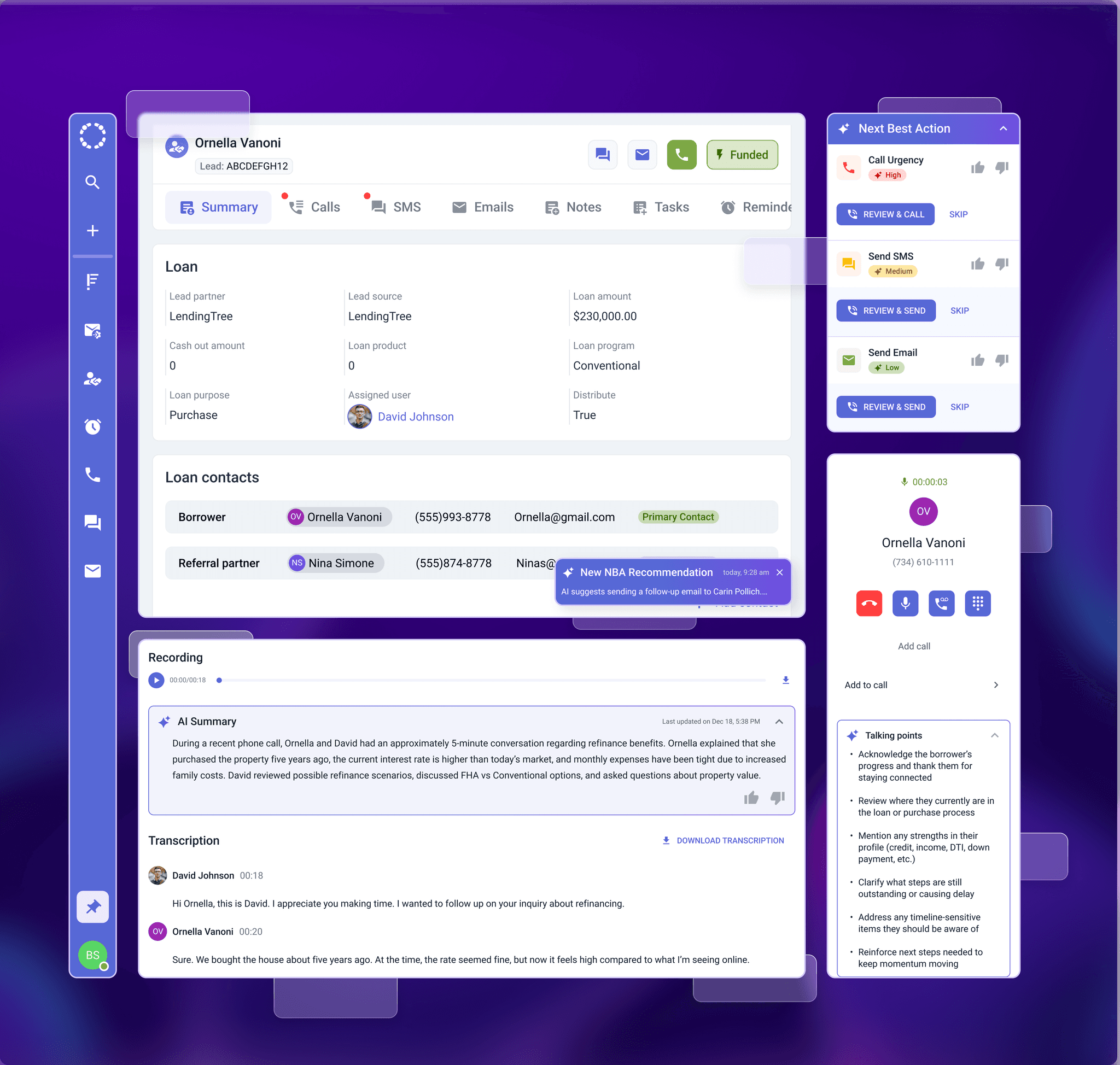

Next Best Action

Real-time recommendations for every borrower

03

Next Best Action

Real-time recommendations for every borrower

03

Next Best Action

Real-time recommendations for every borrower

04

Call Transcription

Every conversation captured and summarized

04

Call Transcription

Every conversation captured and summarized

04

Call Transcription

Every conversation captured and summarized

05

AI Summarization

Instant briefs on borrower status and history

05

AI Summarization

Instant briefs on borrower status and history

05

AI Summarization

Instant briefs on borrower status and history

06

Propensity Scoring

Know who's ready to close, refinance, or churn

06

Propensity Scoring

Know who's ready to close, refinance, or churn

06

Propensity Scoring

Know who's ready to close, refinance, or churn

Trusted by

Trusted by

Meet the Team

Guiding principle

Guiding principle

If you want to build a ship, don't drum up the people to gather wood, divide the work, and give orders. Instead, teach them to yearn for the vast and endless sea.

― Antoine de Saint-Exupéry

If you want to build a ship, don't drum up the people to gather wood, divide the work, and give orders. Instead, teach them to yearn for the vast and endless sea.

― Antoine de Saint-Exupéry

Amazing team members

Amazing team members

Our Investors

All-In-One Platform

Stop Stitching Together Point Solutions.

Everything You Need. Nothing You Don't.

Lead Management

Capture Score Distribute Nurture

Omnichannel Communication

Voice SMS Email in one place

Marketing Automation

Campaigns that run themselves

Pricing & Proposals

Integrated pricing engine

Workflow Automation

Rules-based automation across the loan journey

Data Analytics

Real-time insights and reporting

Customer Data Append

Credit Property Public Records Built in

Customer Data Append

Credit Property Public Records Built in

AI

Voice AI SMS AI Next Best Action Scoring

AI

Voice AI SMS AI Next Best Action Scoring

Deeply Specialized for Mortgage and Deposit Teams

Relcu is engineered around the regulatory, operational, and revenue realities of financial institutions — with mortgage and deposit workflows built natively into the platform.

Not a retrofitted CRM. Not a patchwork of disconnected systems.A System of Action purpose-built to execute.

Channels Supported

Consumer Direct

Retail

Wholesale

The Performance Standard

Accelerating Revenue. Maximizing ROI. Defining the Category.

x

Faster Lead Response

Capture revenue before competitors do.

x

3

Faster Lead Response

Capture revenue before competitors do.

x

Higher Conversion Rates

Turn demand into funded volume.

x

4

Higher Conversion Rates

Turn demand into funded volume.

%

More Loans Closed per LO

Increase revenue per producer

%

120

More Loans Closed per LO

Increase revenue per producer

%

Lower Cost per Funded Loan

Maximize return on every marketing dollar.

%

53

Lower Cost per Funded Loan

Maximize return on every marketing dollar.

Testimonials

What Our Customers and Partners Say About Us.

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

We’ve been with Relcu since the beginning, and they continue to exceed our expectations. Abhi, Sergey, Trip, and the team are responsive, professional, and truly invested in our success. Even as we’ve pushed the platform to its limits, Relcu has remained stable, scalable, and reliable. Their powerful API and new AI capabilities make them a clear leader in customer conversion and retention. It’s been a pleasure to grow alongside them.

Johan Kriegbaum - Beeline

Head of Continuous Improvement

Relcu plays a critical role in our strategy to stay ahead in today’s fast-changing technology landscape. By combining forward-thinking strategy with cutting-edge AI innovation, they empower us to accelerate growth. We value them as a trusted partner driving meaningful transformation.

Dan Stevens - NBKC Bank

SVP Customer Acquisition

With its breadth of integrations and powerful sales automation, Relcu enables mortgage originators and banks to modernize operations, personalize engagement, and drive growth in conversion, retention, and cross-sell.

Neal Kapur- Valley Ventures

Partner

Relcu is a perfect example of how AI is driving true capacity expansion and meaningful cost savings inside of at-scale financial institutions today. We’ve seen their solution creates real ROI for originators in weeks vs months and they have one of the rare fintech platforms with applicability across mortgage, deposit and small business.

Vivek Krishnamurthy - Commerce Ventures

Partner

Who it's For

Who it's For

Built for Your Entire Team

Built for Your Entire Team

Loan Officers

Close more. Chase less.

AI handles follow-ups so you focus on borrowers ready to close

Loan Officers

Close more. Chase less.

AI handles follow-ups so you focus on borrowers ready to close

Sales Leaders

Every lead worked. Every time.

Full vsibility and automation across your entire team

Sales Leaders

Every lead worked. Every time.

Full vsibility and automation across your entire team

Marketers

Campaigns that convert.

Omnichannel execution with built-in attribution.

Marketers

Campaigns that convert.

Omnichannel execution with built-in attribution.

Marketers

Campaigns that convert.

20 website

Enterprise

Scale without complexity.

One platform across all channels and business lines.

Enterprise

Scale without complexity.

One platform across all channels and business lines.

AI Agents

Never sleeps. Never forgets.

Calls, texts, follows up, qualifies leads, and keeps every deal moving.

AI Agents

Never sleeps. Never forgets.

Calls, texts, follows up, qualifies leads, and keeps every deal moving.