Relcu platform

Book a Demo

Book a Demo

Accelerate Digital Mortgage Transformation through Meaningful Customer Relationships

Your Loan Officers strive every day to provide exceptional customer service and create customer relationships to increase customer lifetime value. Their goal is to make home buying a stress-free process by adding joy and value to the customer journey at every step.

Therein lies the challenge: There are far too many engagement touchpoints across diverse channels, multiple disconnected systems, disparate partners and distributed customer data making it hard for your loan officers to offer a consistently high quality and seamless customer engagement experience.

We believe that creating robust user experiences is the foundation for building strong and lasting customer relationships. Unlike a plethora of point solutions that mortgage lenders typically rely on to serve and support their customers, Relcu provides one, end-to-end solution.

It enables the majority of standard mortgage business processes “out of the box” which can be completely customized via drag drop, no-code workflows and configurations.

Your loan officers now

can be efficient and simplify the mortgage process in an integrated platform, equipped with a holistic, 360° view of the customer.

At an organizational level, you can rely on a single lead-to-funding platform to communicate with your customers, internal teams, and your partner ecosystem. Integrations across mortgage ecosystem allows for feature-rich workflows across the loan process which improves your workforce productivity and efficiency.

As a single-application solution, Relcu unifies lead management, customer digital communication, pricing, proposal, loan pipeline management and partner ecosystem integrations. Centralized, 360° view of the customer enables robust data validation and actionable data insights.

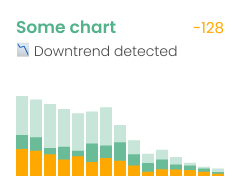

Fast and efficient lead distribution, lead scoring, lead contact strategy and acquisition decisions

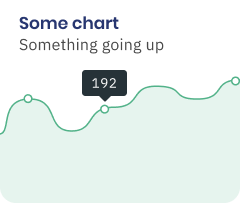

Automated and standardized customer digital engagement experiences with clear and timely updates throughout the customer journey

Built-in data models on lead data for efficient lead distribution, on timeline data for next best action and on loan data for propensity to close

Reduced cost for lead acquisition and higher lead conversion

Streamlined and optimized customized business processes that boost organizational efficiencies

No longer will your mortgage business have to adapt to predefined software functionalities and workflows. Relcu facilitates flexible task and workflow automation. This enables your mortgage business to take ownership of end-to-end processes throughout the customer journey.

The Relcu solution helps you be profitable in a dynamic market through higher lead conversion, higher loan volume, lower loan production costs and higher customer lifetime value.

Built-in capabilities that help you remain compliant with security practices and industry-specific regulations, policies and standards

Benefit from greater transparency, satisfaction and exceptional engagement experiences throughout the customer journey. Relcu’s omnichannel communication capabilities allow you and your Loan Officers to pivot their contact strategies in alignment with the customers’ needs and preferences

Enjoy a unified mortgage-focused product platform that helps them own the process from lead-to-funding. They can effectively nurture and manage customer relationships throughout their journeys.

Lenders can leverage the pre-built integrations, whether it is the pricing, title, appraisal, private mortgage insurance (PMI) or closing, for process optimization, customer transparency, 360° view and a high-impact digital mortgage platform.

The Relcu platform is tailored for the Mortgage industry, designed to create meaningful customer relationships and effective world-class customer experiences

Pivot around your customers’ needs through real-time, automated omni-channel communication capabilities. Provide a consistent user experience across all digital channels.

Leverage easy-to-use tools and robust marketing contact strategy and customer engagement solutions.

Provide clarity and regular status updates throughout the borrowing journey to improve transparency and help your customers make informed financial decisions.

Deliver greater transparency and satisfaction throughout the customer journey - from pricing, proposal, application, to underwriting, signing and funding.

Leverage customer and market data to predict signals for loan re-engagement with existing customers. Implement carefully curated, communications to drive more business and re-engage existing customers.

Implement carefully curated communications to drive more business and re-engage existing customers

Learn how our flexible, customizable platform can help you drive growth and innovation for your organization by deepening customer relationships.

Call +1 833 611 1189 or contact us online.